Strategic Partnerships for Resilience: Bagley Risk Management

Wiki Article

How Animals Risk Security (LRP) Insurance Can Safeguard Your Livestock Financial Investment

In the world of livestock investments, mitigating dangers is extremely important to making certain monetary stability and growth. Livestock Threat Security (LRP) insurance stands as a reliable shield versus the uncertain nature of the marketplace, providing a critical method to guarding your assets. By diving into the ins and outs of LRP insurance and its multifaceted advantages, animals manufacturers can fortify their financial investments with a layer of security that transcends market changes. As we discover the world of LRP insurance, its role in protecting animals financial investments becomes significantly obvious, assuring a course in the direction of sustainable financial strength in an unpredictable sector.

Understanding Livestock Threat Security (LRP) Insurance

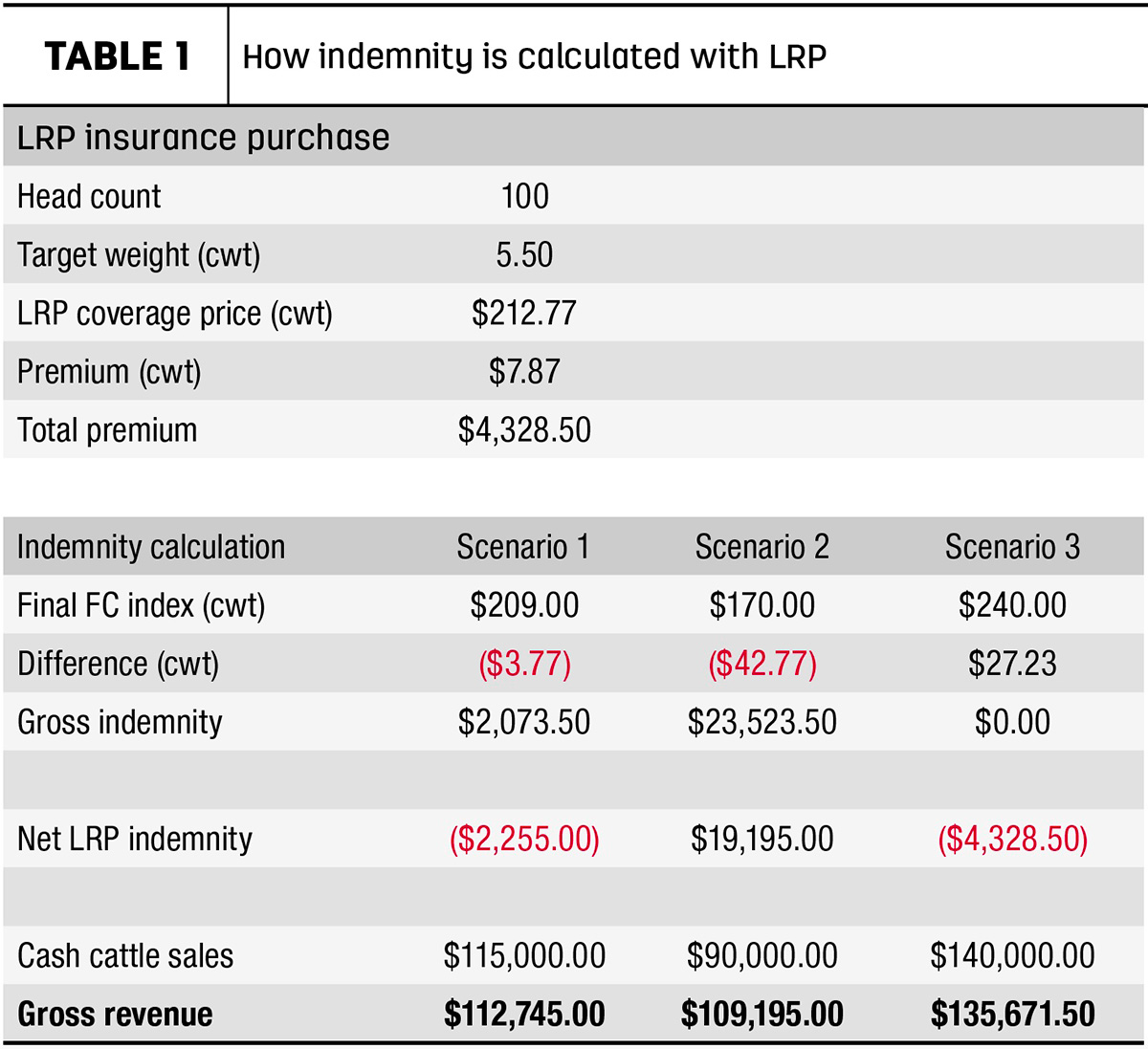

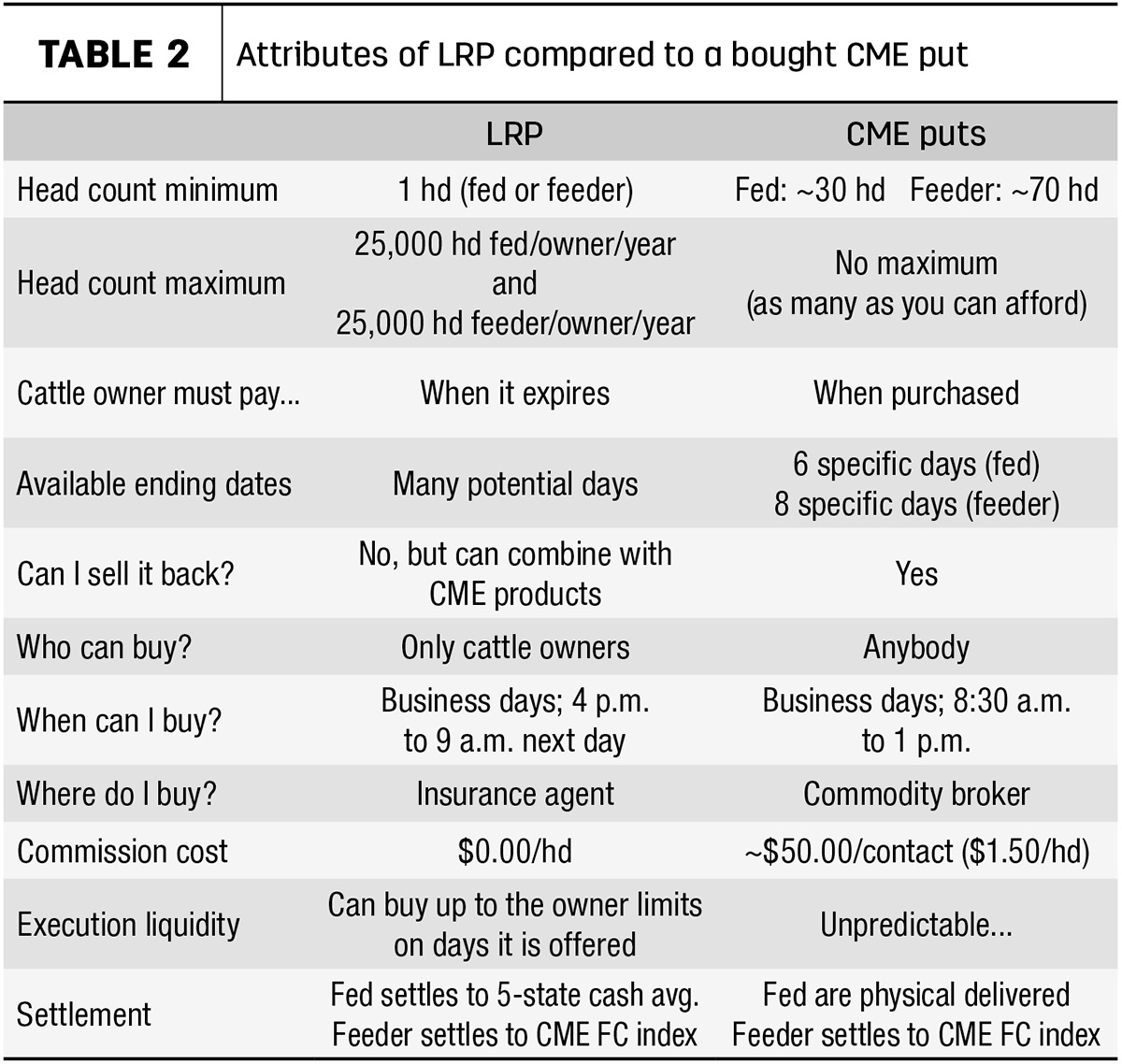

Comprehending Livestock Threat Security (LRP) Insurance is crucial for livestock manufacturers seeking to reduce economic dangers associated with rate variations. LRP is a government subsidized insurance coverage item created to protect manufacturers versus a decrease in market value. By providing coverage for market value decreases, LRP aids producers secure a floor price for their livestock, ensuring a minimal level of profits regardless of market fluctuations.One trick aspect of LRP is its adaptability, allowing manufacturers to tailor coverage degrees and plan lengths to match their specific requirements. Manufacturers can pick the number of head, weight variety, insurance coverage price, and protection duration that straighten with their production goals and take the chance of tolerance. Comprehending these personalized choices is important for manufacturers to effectively manage their cost threat exposure.

In Addition, LRP is available for different animals kinds, consisting of cattle, swine, and lamb, making it a functional risk administration device for animals manufacturers throughout different fields. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, producers can make educated choices to secure their financial investments and make certain financial stability in the face of market uncertainties

Benefits of LRP Insurance Coverage for Livestock Producers

Animals manufacturers leveraging Animals Danger Defense (LRP) Insurance get a critical benefit in securing their financial investments from rate volatility and securing a steady monetary footing in the middle of market uncertainties. One essential benefit of LRP Insurance coverage is rate defense. By establishing a floor on the cost of their livestock, manufacturers can alleviate the risk of significant financial losses in case of market slumps. This allows them to plan their budgets better and make notified decisions regarding their operations without the continuous fear of rate variations.

Furthermore, LRP Insurance coverage supplies producers with tranquility of mind. On the whole, the advantages of LRP Insurance policy for livestock manufacturers are considerable, providing a useful tool for managing risk and ensuring financial protection in an unpredictable market environment.

Just How LRP Insurance Policy Mitigates Market Threats

Alleviating market dangers, Livestock Threat Security (LRP) Insurance gives animals manufacturers with a trusted shield versus cost volatility and financial unpredictabilities. By using protection versus unforeseen price declines, LRP Insurance aids producers protect their investments and keep monetary security despite market variations. This kind of insurance coverage enables animals producers to secure a rate for their animals at the start of the plan duration, guaranteeing a minimal price level regardless of market adjustments.

Actions to Protect Your Livestock Investment With LRP

In the world of farming threat management, carrying out Livestock Danger Defense (LRP) Insurance entails a tactical process to protect financial investments versus market fluctuations and unpredictabilities. To safeguard your animals investment efficiently with Source LRP, the initial step is to analyze the certain risks your operation encounters, such as price volatility or unforeseen weather condition occasions. Comprehending these risks enables you to figure out the protection level required to protect your investment sufficiently. Next off, it is essential to study and choose a trustworthy insurance policy supplier that supplies LRP plans tailored to your animals and business demands. Once you have actually chosen a carrier, thoroughly review the policy terms, problems, and protection limitations to ensure they line up with visit your threat monitoring objectives. Additionally, regularly keeping an eye on market patterns and adjusting your coverage as needed can help maximize your security against potential losses. By adhering to these steps faithfully, you can improve the safety of your animals financial investment and navigate market unpredictabilities with confidence.Long-Term Financial Safety And Security With LRP Insurance Policy

Ensuring withstanding economic stability through the use of Animals Threat Security (LRP) Insurance policy is a prudent long-lasting method for farming manufacturers. By integrating LRP Insurance coverage into their threat administration strategies, farmers can secure their livestock investments versus unpredicted market changes and adverse occasions that might jeopardize their monetary well-being gradually.One secret benefit of LRP Insurance policy for lasting monetary safety and security is the peace of mind it supplies. With a trustworthy insurance plan in position, farmers can minimize the financial threats related to volatile market conditions and unanticipated losses due to factors such as condition outbreaks or natural catastrophes - Bagley Risk Management. This stability permits producers to concentrate on the daily operations of their livestock business without consistent worry concerning prospective economic obstacles

Additionally, LRP Insurance policy supplies a structured technique to managing danger over the long term. By setting certain coverage degrees and choosing proper recommendation periods, farmers can customize their insurance plans to straighten with their financial goals and take the chance of tolerance, making sure a sustainable and protected future for their livestock procedures. Finally, purchasing LRP Insurance policy is a proactive technique for farming manufacturers to achieve enduring economic click for source security and safeguard their resources.

Conclusion

In conclusion, Animals Threat Defense (LRP) Insurance coverage is a useful device for animals producers to reduce market risks and secure their financial investments. It is a sensible option for safeguarding livestock financial investments.

Report this wiki page